Key Takeaways

- There are different types of IRS audits - correspondence audits, office audits, and field audits

- Stay organized with your paperwork - you'll need it to show the IRS that everything on your return is correct

- You have rights when dealing with the IRS - knowing them helps you feel more confident and in control

- Having a tax attorney help you can make everything easier, especially when talking to and providing written responses to IRS revenue agents

- Planning your taxes carefully now reduces your audit risk and sets you up for success

The Three Types of IRS Audits

- Correspondence audits are the most basic - the IRS sends you a letter asking about specific items on your tax return

- Office audits mean you'll need to visit the IRS office and meet with someone to explain your deductions and paperwork

- Field audits are the most thorough - an IRS agent comes to your home or business to look through all your records

IRS Exams vs. IRS Criminal Investigations

- The auditor suddenly stops communicating or returns documents without explanation

- Questions shift from specific items to patterns of behavior across multiple years

- The focus turns to your personal spending or lifestyle relative to reported income

- Investigators start contacting third parties like employees or business partners

Steps Involved in an IRS Audit

- The IRS sends you a letter telling you you're being audited

- You'll need to gather all your tax records and paperwork

- You'll send the IRS everything they asked for

- Having a tax attorney help you can make the whole process easier

- At the end, the IRS makes their decision and tells you what happens next

Timeframes and What to Expect

How Audits Are Selected

Common IRS Audit Triggers

High-Income Reporting Patterns

Unusual or Excessive Deductions

- Keep your deductions in line with what's normal for your type of business

- Save every receipt and keep detailed records to back up what you're claiming

- Talk to your accountant and tax attorney before making big decisions about what to deduct

Reporting Losses in Multiple Years

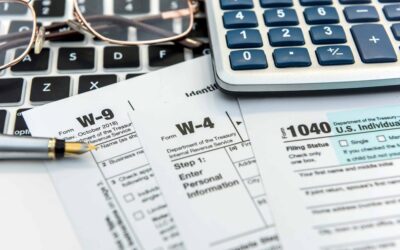

Discrepancies Between Forms and Returns

- If the income on your return doesn't match your W-2s or 1099s

- This is a big red flag for the IRS

- Double-check your numbers before filing

- If your deductions seem off

- Keep every receipt and record

- Be ready to prove each deduction

- If you're reporting anything about property

- Talk to a tax pro first

- Make sure you're handling it the right way

Tips to Avoid Red Flags in Future Filings

Preparing Essential Documentation for Your Defense

Gathering Financial Records and Receipts

Organizing Tax Forms and Supporting Documents

Write a Clear Response

Keep Accurate Records Moving Forward

- Use your phone to scan and save receipts

- Try accounting software to track your money

- Make checklists so you don't forget anything important

Tools and Resources for Document Management

Your Rights During an IRS Audit

Your Basic Rights

What Can the IRS Ask For?

Why You Need a Tax Lawyer

- Looks at your situation and plans the best way to handle the audit

- Helps gather and organize all your paperwork

- Talks to the IRS for you so you don't accidentally say something that could hurt your case

Keeping Things Confidential

Staying in Compliance

Dealing with IRS Revenue Agents

Speaking with IRS Agents

Answering Their Questions

Managing Stress During the Audit Process

Get Professional Help

What Happens After Your Audit

Reviewing the Audit Findings

If You Disagree With The Audit Results

- Your lawyer can file an appeal within the 30-day deadline

- They can negotiate with the IRS for you

- If needed, they can take your case to US Tax Court

Navigating the Appeals Process

Handling What You Owe

| Collection Alternative | Description | Benefits |

|---|---|---|

| Installment Agreements | Allows you to pay off the tax debt over time in manageable monthly installments. | Helps preserve financial stability by spreading out payments. |

| Offer in Compromise | Settle the tax debt for less than the total amount owed. | Can significantly reduce total tax liability if you qualify. |

| Penalty Negotiation | Taxpayers may negotiate penalties based on reasonable cause or mitigating circumstances. | Reduces overall tax burden when circumstances warrant penalty relief. |